Latest Bloomberg Report Says Bitcoin Is Replacing Gold Faster Than Expected

In a report For Bloomberg, senior markets editor John Authers writes about the rise of Bitcoin as an inflation hedging asset. The report explores how the cryptocurrency boom has been to the detriment of gold. To determine the "true" value of Bitcoin, Authers proposes to derive it from its hypothetical absence and the current economic context. Historically, people have used gold as an asset to protect themselves when there was a high risk of inflation. The author states:

“Treasuries outperform gold when people are not overly concerned about inflation, while gold wins when there are inflationary concerns. Except for the present, both are falling ”.

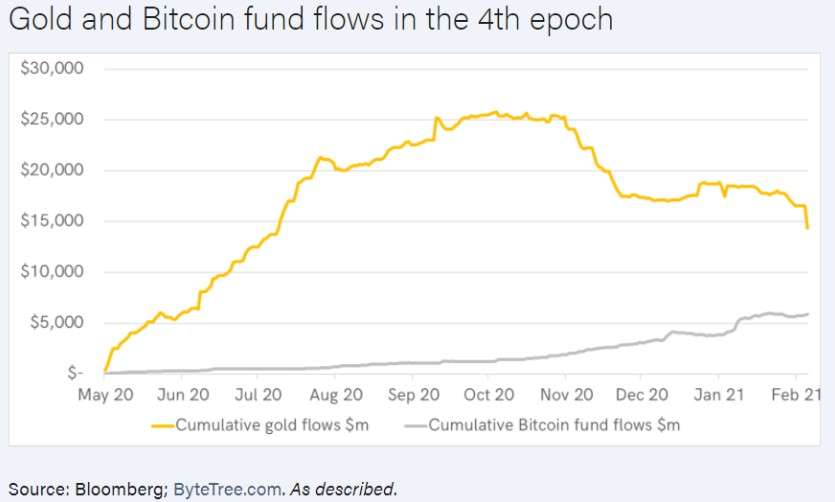

As the graph below shows, the performance of the price of gold relative to silver has fallen over the past year. This period of panic is unusual. Since 1980, gold has appreciated within this radius. This occurred even in a time of "panic" when historically the opposite should be true.

According to research by Dhaval Joshi of BCA Research, cited by the author, the demand for gold has increased when people search for an “anti-fiat” asset, when gold is lost. trust in governments or in the long-term purchasing power of a currency. Basically everything that has happened since the Covid-19 pandemic. To explain why gold has not appreciated, Authers said:

“Bitcoin has become an alternative anti-fiat asset. It has been popular due to the anti-government libertarian ideas that have accompanied the digital currency since its inception. Bitcoin's upscaling to be better known and much easier to obtain now makes it a much more viable competitor to the shiny metal. "

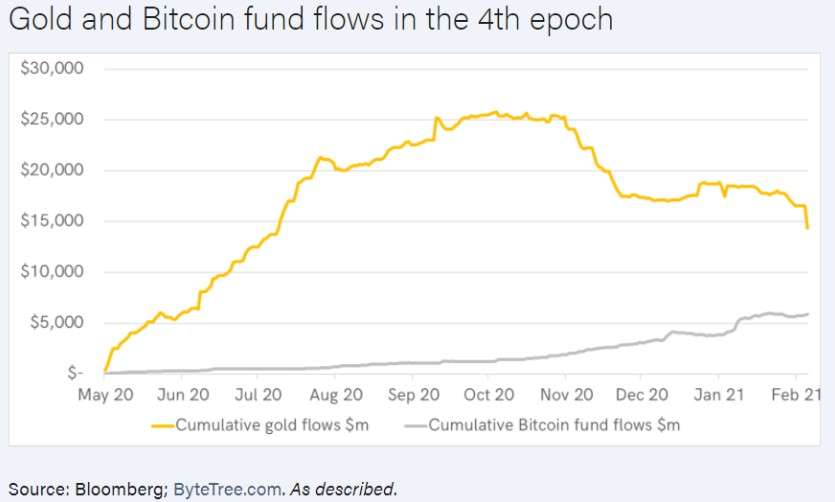

Bitcoin captures gold market share

As proof of this, the author presents the following graph. This shows the decrease in the cumulative flow of gold versus the increase in flows in Bitcoin.

This occurs when investors decide to allocate capital to Bitcoin, cryptocurrency-based derivatives, or financial products that give direct or indirect exposure to BTC. Institutions have made the biggest bet on cryptocurrency. At least, that's what the decline in searches for "Buy Bitcoin" seems to show, based on Google data. Authers adds:

“Bitcoin's performance over the last year is directly in line with movements in bond yields. When returns increase, so does Bitcoin. This implies that the digital currency benefits directly from 'reflation trading', or the belief that inflation is approaching ”.

In conclusion, Authers determines that there is a correlation, positive for BTC and negative for gold, caused by the fear of the increase in the inflation rate. In this case, the precious metal is perceived as the "weakest" anti-inflation asset compared to Bitcoin.

In parallel, the author finds a connection between the current stagnation in BTC and the "pause" in the bond market. Like cryptocurrencies, 10-year Treasuries have moved sideways for the past 30 days.